Crypto Options and Goldfinger Attacks

Bitcoin is growing up. Don’t cheer yet; what I mean is that the markets’ enfant terrible just got the financial equivalent of a Driver’s License …and, to push the metaphor, is also of legal drinking age. Cryptocurrency derivatives have arrived.

Cryptocurrency Futures and Options

LedgerX, a Bitcoin swap and options clearinghouse with CFTC approval, went live in what they’re terming a “soft launch” in which a few invited participants essentially beta-test-for-keepsies their platform. Their soft launch exceeded volume expectations and millions of USD in notional value has already been transacted. Further, according to the Wall Street Journal the CME is considering launching BTC futures contracts.

This could mean a lot. The ability to create portfolio insurance products for crypto assets could finally convince more conservative players to enter the space. Hedging through very liquid exchanges could facilitate transactional use (y’know, the thing cryptos were invented for in the first place….) There will be no shortage of speculation on the bullish side of ramifications of crypto derivatives, so I will leave that alone. Conversely, however, the new options market could incentivize blockchain attacks which the game theory of decentralized payment systems has generally precluded up until now.

This could mean a lot. The ability to create portfolio insurance products for crypto assets could finally convince more conservative players to enter the space. Hedging through very liquid exchanges could facilitate transactional use (y’know, the thing cryptos were invented for in the first place….) There will be no shortage of speculation on the bullish side of ramifications of crypto derivatives, so I will leave that alone. Conversely, however, the new options market could incentivize blockchain attacks which the game theory of decentralized payment systems has generally precluded up until now.

What is a Goldfinger Attack?

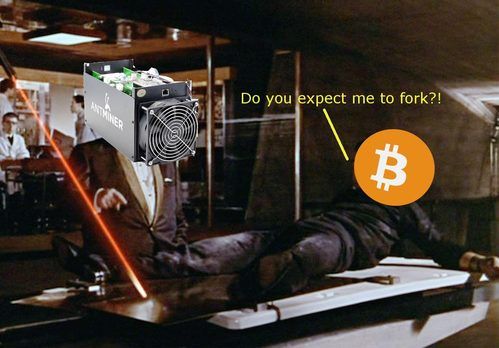

In a market environment where shorting is difficult, “51%” attacks on the blockchain are generally a bad strategy since the miner is also attacking the value of the asset he’s trying to acquire or double-spend. It’s more profitable to be a good actor and simply race to verify blocks. This alignment of incentives for miners, holders [sic], and spenders is one of the things that makes Bitcoin work better in practice than it does in theory. With the derivatives and futures market, you can now take a position that rewards you for attacking the blockchain. This is the so-called “Goldfinger” attack (If you don’t get the reference, you have an excuse to rewatch a classic Bond film).

Here’s a Bitcoin Goldfinger attack scenario. You are one of the largest Bitcoin mining farms. Minin’ ain’t easy; in addition to your hard-working depreciating ASICs, you have Moore’s Law as a headwind, new players are entering the space, your relationship with your government may be tenuous, ever-shifting, unclear (looking at you, China). Finally, the BTC/local currency price starts softening. There goes your margin in a blaze of red candlesticks. Alluringly, there is a highly liquid, deep, derivatives market for BTC. Why not load up on cheap, out of the money puts and short futures contracts then double-spend transactions, spam nodes, move your hashing power to another SHA-256 protocol. If you have some political clout in the community propose a frivolous fork with some complicit developers to undermine trust. Basically, the a laundry list of attacks that the trustless payment systems are subject to.

This is admittedly an extreme depiction, but miners, cabals of nodes, rogue developers can do a subset of these attacks. Even a well-heeled investment bank trading desk could buy hash power to supplement some old-fashioned market manipulation.

Here’s a Bitcoin Goldfinger attack scenario. You are one of the largest Bitcoin mining farms. Minin’ ain’t easy; in addition to your hard-working depreciating ASICs, you have Moore’s Law as a headwind, new players are entering the space, your relationship with your government may be tenuous, ever-shifting, unclear (looking at you, China). Finally, the BTC/local currency price starts softening. There goes your margin in a blaze of red candlesticks. Alluringly, there is a highly liquid, deep, derivatives market for BTC. Why not load up on cheap, out of the money puts and short futures contracts then double-spend transactions, spam nodes, move your hashing power to another SHA-256 protocol. If you have some political clout in the community propose a frivolous fork with some complicit developers to undermine trust. Basically, the a laundry list of attacks that the trustless payment systems are subject to.

This is admittedly an extreme depiction, but miners, cabals of nodes, rogue developers can do a subset of these attacks. Even a well-heeled investment bank trading desk could buy hash power to supplement some old-fashioned market manipulation.

Best Practices in Era of Short-Interest

What can you do about this? You should stay away from margin accounts of all types and don’t use stop loss orders even in liquid exchanges. Honestly, BTCUSD is so volatile that those are good practices anyways. You can keep an eye on the futures and options markets or a service that does so for you. Most importantly, realize that this is a required step in the growth of cryptocurrencies. Stocks, bonds, and traded currencies all are subject to coordinated selling campaigns, activist investor litigation, public sentiment and market manipulation. This has been going on since at least the 17th century in the Netherlands. Bitcoin must also survive bear raids as it becomes more ubiquitous, it’s simply that the tools at the bears’ disposal are different because the asset class is different as well.

Recent

Charitable Giving (and Deducting) Cryptocurrency

September 27th, 2021

Quantum Computing and Satoshi's Sunken Treasure

July 30th, 2019

Profiles in Capitulation: The End of the Bear Market

September 7th, 2018

Scaling Cryptocurrency Protocols

August 7th, 2018

The Virtuous Cycle of Masternodes

January 20th, 2018

Archive

2021

2018